Recent news

ARTISANAL GOLD: OPPORTUNITIES FOR RESPONSIBLE INVESTMENT

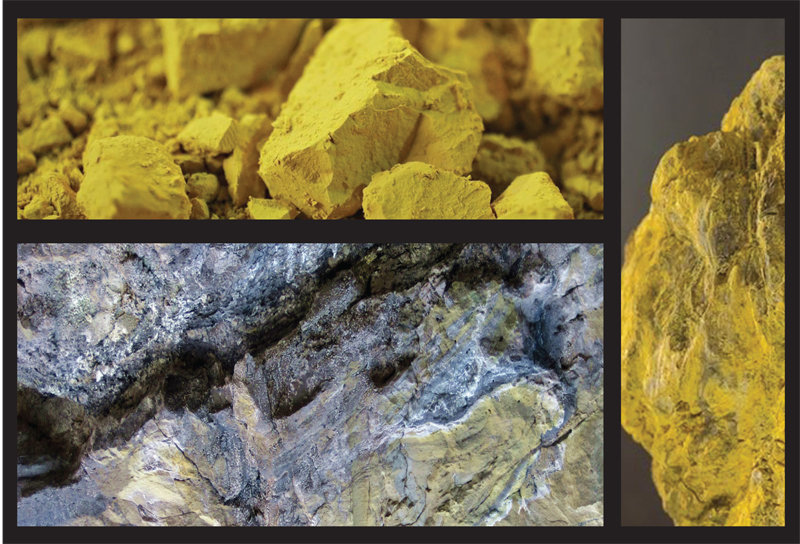

Artisanal and small-scale gold mining (ASGM) is a significant source of livelihood for millions worldwide. The industry is diverse and can range from individual panners to larger and more mechanized operations. Often an informal business, ASGM is the chief source of income for many rural, low-income communities in the developing world for whom alternative jobs pay less. Globally, the sector accounts for approximately 20% of the gold supply, making it around a USD 35 billion per year industry. Poorly practiced and unsupported by governments, ASGM can be a source of significant negative social and environmental impacts, including the widespread use of mercury, a highly toxic metal. However, when governed well and conducted responsibly and with appropriate environmental safeguards, ASGM can generate significant income and positive social and health benefits for miners and their surrounding communities.

Gold glitters in the economic gloom

It is heartening to see that the gold sector is being developed in the proper professional way, following strict business principles. Mongolian gold export was the highest ever in 2020, and because prices were high, gold earned almost the same as copper concentrate and coal. In a way gold glittered in the gloom of the pandemic.

Aware of gold’s contribution to the foreign currency reserve and thus helping keep the MNT stable, the government is putting a priority on increasing both extractable gold reserves and production and also building a refinery.

The market has never been better than it was in 2020. In August, the price reached $2067/oz, beating the previous highest recorded in 2011. The year’s average price was $1769.6/oz.

Committee set up to help MONVAL Code secure international approval

Given that revenue from mining is the mainstay of the Mongolian economy, it is important to create conditions that would help bring more investment in our exploration and extraction sectors, so that in time we have more mineral resources to export. One way to do this is to follow methods and processes consistent with the global best practice when putting a value on mineral deposits and mining operations. Investment in both exploration and extraction will come only when potential investors can be sure that the object of their interest has been reliably valuated, using internationally accepted methods and codes. Apart from bringing foreign investors into Mongolia, this would also help domestic companies place their assets in stock markets, both international and local.

We have a mining policy; is it implemented?

The Mining Sector Policy 2020-2024 which forms part of the Government’s Action Plan was developed in cohesion with Vision 2050, a document of long-term development. The Khurelsukh government was in power for only seven months so it will not be right to talk about its success or failure in implementation of the policy, except in very general terms, but we could look at the status of certain individual projects, remembering that the entire period was marked by unforeseen economic and social difficulties generated by the pandemic.

The Government must be credited for ensuring that mega projects such as the oil refinery, development of the Oyu Tolgoi underground mine, and construction of the railway moved forward without interruption. This showed that the focus is shifting from extraction to export of value-added products. However, we heard nothing about the copper smelter.

Will 2021 be the year of copper?

Last year was not good for Mongolian coal, with exports earning almost $1 billion less than in 2019. This year, too, exports are not expected to top the 28.6 million tonnes in 2020, which was the lowest since 2017, when the figure stood at 33.4 million tonnes.

According to the National Statistics Office, the total revenue from mineral exports in 2020 was $5.26 billion, down 17.6 percent from the previous year, mainly because of the decline in coal exports. The loss to the country would have been greater if gold had not come to the rescue. The more than 30 tonnes sold by The Bank of Mongolia earned around $1.8 billion, offsetting the loss from coal`s underperformance. However, gold is unlikely to repeat its feat in 2021. In any case, of the 30 tonnes exported last year, only 23.6 tonnes had been bought by the central bank during the year, the rest comong from its reserves.

An ambitious plan needs prudent handling

The Government has prepared a list of 100 projects for implementation in the coming four years, and will release it as it completes 100 days in office. The focus is on import substitution and production of value-added products for export. MNT10 trillion would come from the state budget for some of these projects, and long-term loans – there is no word on their amount -- from foreign donor organizations would be used for some others. Another MNT47 trillion would have to come from foreign investment, in the form of public-private partnership/concessions, and as private investment. The government is exploring where to look for the money. The Spring session of parliament, beginning in April, is expected to approve the projects and their investment source.

BoM to continue financial support to gold miners

In 2020, the Bank of Mongolia (BoM) bought 23.6 tonnes of gold, 8.3 tonnes more than in the previous year, helping raise the country’s foreign exchange reserve to $4.5 billion, 4.2 percent more than what it was a year earlier. The amount of the difference is enough to meet import needs of the country for 11 months. P. Erdenetuya, Director of the Treasury Department at Mongolia’s central bank, tells L. Nomintsetseg more about how the BoM buys precious metals and how it plans to support gold mining.

Mining to be main issue in presidential election

Note: The first part of this article was written before U. Khurelsukh resigned as Prime Minister. As such, all references to “the Prime Minister” in it should be understood to refer to him as the ex-Prime Minister. Recent days have found the president frustrated as it becomes clear that the amended Constitution has reduced his power, while granting more to the Prime Minister who once compared himself to “a lion with no teeth”. At one time, they felt the same about many things, both expressing themselves in favour of bringing under state ownership deposits where exploration had been carried out with State money, confiscating oligarchs’ assets in accounts abroad, and implementing an equitable policy on distribution of wealth to citizens. Such unanimity at the top made people wonder if Mongolia was going back to being a socialist country, and a vocal group came up applauding the possibility and berating “the 31 families” which, it said, had become rich by cornering mineral deposits.

Foreign trade shows $2.28-billion surplus in 2020

Mongolia’s foreign trade turnover for the full year in 2020 reached $12.9 billion, 6.4% or $876.9 million less YoY. Exports accounted for $7.6 billion, down 0.6% YoY, and imports fell 13.6% YoY to $5.3 billion. The foreign trade balance shows a $2.28-billion surplus.

In terms of mineral exports, 28.6 million tonnes of coal were exported, 7.9 million tonnes or 21.6% less YoY. Revenue from this fell 30.9% to $2.12 billion. The figures for December show that 1.6 million tonnes were exported, 5.6% less YoY and 49.3% less than in November.

Gold was the second largest earner among minerals exported, with 30.5 tonnes exported for $1.79 billion, showing a YoY increase of 236% in volume and 327% in value. Exports in December stood at 2.8 tonnes and earnings at $163 million.

Atomic Energy Law to be amended to attract investment

The Atomic Energy Law, amended six times since it was passed in 2009, is going to have fresh changes to bring its 8 sections and 51 articles in conformity with the post-amendment Constitution. A working group headed by N.Myagmar, Chairman of Legal Department of the Government Secretariat, and with members representing several departments has been set up to prepare the draft amendments. It is still early days and the group is yet to determine the overall rationale for the amendments, but it has started receiving ideas and proposals from the Government Secretariat and from ministries and agencies.

2021 promises to be great, but we must make it so

The year that has just ended was one that changed the way we live anywhere in the world. A pandemic held human interaction hostage and stalled economic progress, and no one can say how long it would take to undo the damage. Mongolia has not been exempt from the disruption in all areas of life, with exports and revenue falling, but our sparse and widely distributed population, helped by strict Government measures, has kept the number of casualties low. Hope springs eternal in the human breast, and as we begin a new year, Mongolians, individually and collectively, look forward to an end of the crisis and to new opportunities opening up.

Building Mongolia’s railway of hope

Trucks with some cover over their cargo of coal move at speed in a seemingly unending line along the road to Gashuunsukhait. Not all make it to the border, though, as accidents are common on the often potholed road, but the overturned or otherwise affected trucks are quickly moved to a side so as not to impede the flow. There is a similar flow in the reverse direction of empty trucks returning from the southern border. The road is kept clear for the economically important traffic, but there is garbage of all kinds on the sides, with the lighter stuff blown in all directions by the wind. Everything is made dark by the dust from the coal and the soil dispersed by the heavily laden trucks. This is how the lifeline of our coal export has been like for the past several years, as we have watched in dismay a decade pass by with much talk and more politics but no progress on the ground on building the TT-GS railway.

How miners are being successfully protected

With the number of locally transmitted cases rising, the mining sector is also in a vulnerable situation, but as it is the mainstay of the national economy, the government is determined that normal mining operations are not interrupted. Special efforts are being made to keep the virus away from Umnugovi aimag, Mongolia’s mining hub. A “green zone” has been demarcated near the border and there are also “safety zones”, intended by the Government to protect all inside them from the risk of being exposed to the virus. A working group headed by O.Batnairamdal, Deputy Minister of Mining and Heavy Industry, is camping in the mining zone to supervise strict compliance with the infection control regime put in place, so that mining does not stop and export continues.

Oyu Tolgoi announces Q3 2020 performance results

Oyu Tolgoi LLC has highlighted the following in its latest performance scorecard that gives key performance metrics for the third quarter of 2020, and provided an update on underground development, and its continued prevention measures on COVID-19.

• Awarded the Copper Mark for responsible production.

• Paid $201 million in the form of taxes, fees and other payments to the Government of Mongolia as of the end of the third quarter of 2020. Since 2010, Oyu Tolgoi has paid $2.8 billion in taxes, fees and other payments including VAT to Mongolian suppliers.

“It would take more than just a year to mitigate the losses”

Talking to E. Odjargal before the lockdown in November, S. Bold, Senior Economist at the Asian Development Bank (ADB), comments on whether Mongolia needs a new wealth fund, and on the economic situation during and likely after the pandemic.

What do you think of the proposed national wealth fund?

Mongolia already has the necessary legal environment for proper management of its mineral resources revenue. What it needs is to pay more attention to see that the laws are followed and money actually goes into these savings funds and stays there. The Fiscal Stability Law was passed in 2010 to protect the state budget against fluctuations caused by mining “cycles” but in fact, an amount not lower than 5 percent of the GDP, mandated in the law as amended in 2017, has not been put into the Fiscal Stability Fund, let alone the 10 percent envisioned in the original.

“We would get the required amounts in time”

T.Munkhbayar, Executive Director of Erdenes Silver Resource LLC, tells G.Iderkhangai how his company, working with its own money, is moving towards fulfilling the responsibility given to it by the Government. He also clears up certain popular misconceptions about the deposit and its potential.

What are the main things your company has done so far?

Our company was set up in June, 2019 as a daughter company of the fully state-owned Erdenes Mongol Group to act in due course as a reliable source of revenue for the state budget. We self-finance our operations at the Salkhit silver and gold deposit, without any financial support from the Government. We have been organizing activities for our staff to improve their knowledge and skills so that mining operations can begin without delay and we can post profits before long.

Working on the road map to recovery

The recently held Discover Mongolia International Mining Investors’ Forum was the 18th in an annual series, and the first since Mongolia had a new Parliament and Government, both committed to enabling and ensuring the return of foreign investment to the country. Despite the fact that the forum was this time held in the backdrop of the global economy – as also the individual economy of each and every country – struggling under the Covid-19 pandemic, participants and speakers kept their focus on the declared motto, “Mining: The Road to Recovery”.

Taking a broad view, they discussed the likely policy of the newly elected Mongolian ruling set-up on the economy and mining, possible countermeasures for the economic recession, the need for a policy shift to revive the exploration sector, the planned amendment to the

“Pandemic or not, mining cannot stop”

D.Enkhbold, Executive Director of the Mongolian National Mining Association, tells MMJ that if mining were to stop, the country would be crippled. He also details how the sector is getting used to the restrictive regulations during a state of emergency.

What is the situation in the mining sector at a time of strict quarantine and a state of emergency?

There is no way work in the mining sector can stop even after we have local cases of the infection. If it stops, all 21 aimags and Ulaanbaatar will run out of fuel and electricity. At the same time, if exports stop, the country’s economy will collapse. Each mine is implementing a safety regimen to prevent the spread of the virus. Most companies had already prepared an action plan for this situation.

“It is impossible to develop heavy industry without solving the issue of water”

G.Yondon has brought a lifetime’s experience of working in senior positions in the mining sector to his new charge as Minister of Mining and Heavy Industry. This gives him an insider’s understanding of the importance to properly develop the sector. The pandemic was a baptism of fire, and in this interview, he tells G. Iderkhangai about how things are improving, and about the policies that would direct the path the sector takes in both the short and the long terms.

“Corruption must be kept out of our wealth fund”

First, let us be clear about how much money we are talking about. Our economic size is $13 billion, and 30 percent of this comes from the mining sector. We have less than MNT1 trillion in the Future Heritage Fund, and the draft budget for 2021 estimates that another MNT1.2 trillion would go there. If the average fresh accumulation in it is MNT1 trillion every year, in 2030 the fund will have MNT10 trillion or $3.5 billion at today’s rate.

Now the government wants another and a new wealth fund, made up with profits from operating strategically important deposits. What it means is that part of the revenue from mining will go into the proposed fund and the other part to the Future Heritage Fund. We do not know how the revenue would be shared, but if it is a 50:50 split, then the Future Heritage Fund and the new fund will each get an estimated $1.7 billion.