The Mongolian Mining Journal /March.2022/

B.Tugsbilegt

The West is set to refuse Russian cheap, high quality commodities. And Russia thirsts for western materials. This is a game of ‘let’s starve together’. When a small economy is hit by sanctions from a big economy, the small economy is usually expected to compromise. But when there are sanctions between bigger economies, mutual retaliation aggravates the situation. There is no sign of any joint compromise between our northern neighbor and western parties. These hard days are indicating the bleak outlook for this and coming years.

Global economies have been suffering from supply chain disruptions amidst the pandemic, but now things could be worsened. Globalization has made our economies well connected and dependent on each other. But after the armed conflict between Russia and Ukraine, that connection is set to be partially ripped apart. Western countries are starting to impose harsh economic sanctions against our northern neighbor, followed by retaliatory Russian sanctions.

In normal time, the normal principle of supply and demand decides market circumstances but now geopolitical issues are more decisive. In other words, the market is now much dependent on the decisions and emotions of the great powers’ leaders. With post-pandemic recovery, consumption was starting to surge while strong inflation was not yet weakening. But now the commodities crisis is coming amid conflicts between Russia and Ukraine. It is certain that price hikes, minerals and grains supply shortages and slower supply chains will be much felt this year. These could lead to economic recession and financial markets falling. The main shock will be felt by not only vulnerable but also developed economies.

Even before the start of Russian attack (described as ‘a special military operation’ by the Kremlin) on Ukraine, western parties had been planning how to punish it via economic sanctions if military action happened.

They implemented those plans, accordingly including freezing the Russian central bank’s reserve’s half pile or US$300 billion and removing the country’s central bank and other commercial banks from SWIFT. At the same time, the US imposed a ban on energy imports from Russia and Britain promised to do same by the end of the year. But the EU could not move immediately in the same direction but is preparing to end its dependency on Russian energy by 2027, with details to be announced in May.

The freezing of the Russian central bank’ reserves was suggested by Russian President Putin as making the dollar/euro to be unreliable, and so he announced that natural gas payments would have to be made only in rubles by unfriendly countries, including EU and others. The EU criticized that this breached contract terms. But Putin has given a 31 March deadline after which natural gas will have to paid only with rubles.

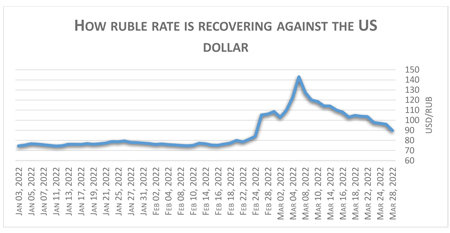

Ruble transactions will strengthen the Russian currency rate and erase the effects of the EU’s sanctions to weaken the Russian economy. That’s why EU’s members are strongly rejecting this decision. But the ruble rate is increasingly getting stronger.

Currently Western countries can hold their position but after less than two months, their gas stocks could be exhausted if Russia cut its natural gas supply entirely. Qatar, one of the leading supplier of LNG to EU, said that it is impossible to replace Russian supply. So, currently it seems that there is no possibility other than EU countries adopting a ruble payment system to get stable energy supply. However, Germany and other bigger economies can rely on the US’s expensive LNG supply for some time, although industrial facilities could cut their output further due to high rated electricity. Actually, the European metallurgical sector has been warning about output cuts due to cost rise since pandemic but things will only get worse. Despite the US being the largest LNG producer, American suppliers tend to play in the spot market during boom times rather than be a source of stable, long term supply. u

Big retreat

President Biden announced a deal on additional 15 billion cubic meters of LNG supply to EU this year, and it could continue to grow its annual supply up to 50 bcm LNG till 2030. Energy experts explain that fulfilling the initial supply promise would take 2-5 years technically, or the US should shift its Asian supply to EU. That shift has already been happening in the recent months when the natural gas price surged in the European market.

At the same time, in this process, Biden’s ‘green image’ could be lost. In the case of US increasing its production, it would further scale up shale gas production, thereby bringing greater greenhouse gas emissions. Generally, unconventional oil production (shale oil and shale gas) accounts for majority of total output in the US. That is being countered with local protests around environmental harms. On the other hand, Biden’s election campaign was widely based on keeping the country’s petroleum production at the same level, and not expanding. So separating EU from Russian energy supply means erasing Biden’s promises to his country’s people. We all remember how Biden expressed strong ambitions in the Glasgow’s climate conference 2021, but now the reverse pattern is unfolding. The Biden administration is trying to explain this as temporary measures to green critics. But more LNG production and export infrastructure will lock more greenhouse gas emissions over the coming 30 years, according to climate critics.

The United States that has a responsibility to lead other countries in the Paris Agreement, is now having to make a big retreat. This will probably allow other countries to behave like the United States and maintain or even increase their fossil fuel production.

“Lonely” Russia

While Western sanctions against Russia are likely to be tightened, Biden’s promise to supply more LNG to Europe faces bigger challenges. The West’s three-pronged sanctions on Russia’s economy include financial, technological and energy sanctions. For example, the United States announced a ban on the supply of chips and semiconductors to Russia. However, Russia and Ukraine are the main suppliers of raw materials for chip and semiconductor production, which could lead to further supply slowdowns and rising prices. On the other hand, sanctions are unlikely to be effective because the United States cannot fully control the chip supply market. In order to combat financial sanctions, Russia has announced that it will trade its natural gas in rubles with “unfriendly” countries. The ruble rate is started to rise from a record low (unofficial exchange rate) of 152 against the US dollar, to 90.

Contrarily, Russian trade with friendly partner countries is set to be settled via national currencies, particularly with China via yuan and with India via rupee etc.

BRICS group (Brazil, Russia, India, China, and South Africa) are increasingly staying and becoming stronger together now. US and UK efforts are to divide the BRICS wall seems too late. If Western parties want to expand their sanctions beyond Russia into China and India, the backfiring consequences would get much worse for them. So the bigger sanctions on other countries are unlikely to happen.

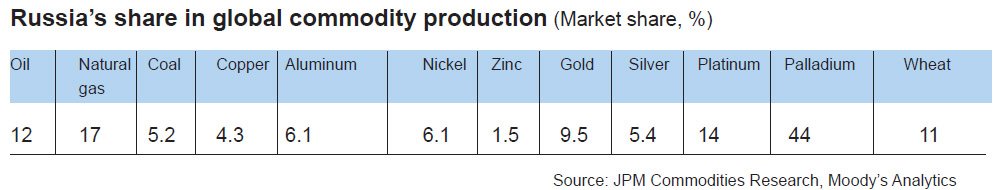

The BRICS market and other Asian potential markets can give big opportunities to Russia to offset revenue losses from the Western market. The EU pays roughly US$1 billion a day for its energy imports (coal, natural gas and oil) from Russia. So the northern neighbor is facing a major goal to find alternative markets to replace its premium market. Russian Urals crude oil is now being sold at huge discount and attracting customers. India and China are becoming major purchasers of Russian oil. And Russian oil producers are earning big because the market price is relatively high. In the long term, if the dispute between the West and Russia is not resolved, the global economy that is familiar to us may not exist, since Russia is a big energy and commodities producer.

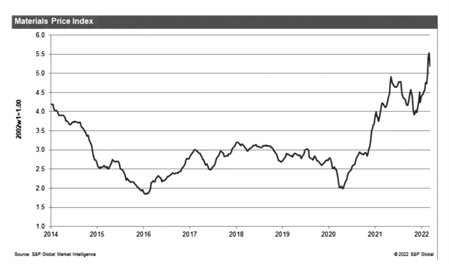

IHS Markit's Materials Price Index

The current uncertainties are also bringing the commodity market to surge. High mineral prices will stay for the long term. Copper is passing US$10000 per ton and nickel, aluminum, zinc and others are also surging. Meanwhile, demand is only getting bigger.

Commodity crisis approaching

Russia and Ukraine are among the biggest wheat suppliers in the world. It is certain that the two countries export will tighten their exports this year. And Russia is also a big producer of fertilizer. In Western countries, a fertilizer price hike was strongly felt from last year and at the same time European fertilizer producers was saying that output would be cut due to high costs of production.

Russian retaliatory sanctions were announced on March 10 and included 200 products. However, the EU is relatively self-sufficient in terms of agricultural products but related imported products and the surging fuel price are impacting on the Union’s food supply and price.

Rising food prices and shrinking supplies are predicted to cause a global food crisis. The World Food Programme (WFP) has warned that the food crisis will be worse in vulnerable countries in Africa and the Middle East, and it called on the European Union to increase funding. WFP warned that food crisis in poor countries could also increase the flow of migrants towards Europe. Ukraine and Russia account for a third of the world’s wheat exports, and shrinking supplies will push up prices for a wide range of agricultural products. China has also warned that the winter wheat harvest could be very poor.

New circumstances

The conflicts between Russia and Ukraine create conditions for our two neighbors’ relations getting stronger and closer. Our southern neighbor is supporting Russian security considerations and criticizing the West for fueling tensions. Starting from the new year, the two countries’ bilateral trade has seen a rapid surge and further expansion is awaited.

Such circumstances have pros and cons, for Mongolia, There is a caution that Mongolia’s coal export market share in Chinese coking coal imports could shrink. Nevertheless, Tavan Tolgoi coal is well acknowledged among the central north Chinese market while Russian coal is more directed to northeastern region. On the other hand, Russian coking coal is exported to not just China but also India.

Our two neighbors’ stronger relations could bring the situation where the big infrastructure and other projects connecting the three countries would progress more quickly. But things are not so simple. How the Western parties will pressure China is now drawing attention. If Chinese growth is impacted, it will potentially cause the three countries related projects’ to be delayed. In addition, our cost for raising finance on the international market could be more expensive.

The impact of the pandemic has not completely disappeared, and the high number of infections in China indicates that Mongolia’s coal and oil exports will not reach the target level this year. Coal exports are expected to increase from April, but will still be much less compared to the previous normal level. Therefore, it is clear that the gold sector in our country will once again be an “economic salvation tool” this year, as the gold price has risen close to $2,000 per ounce.